40 a 10 year bond with a 9 annual coupon

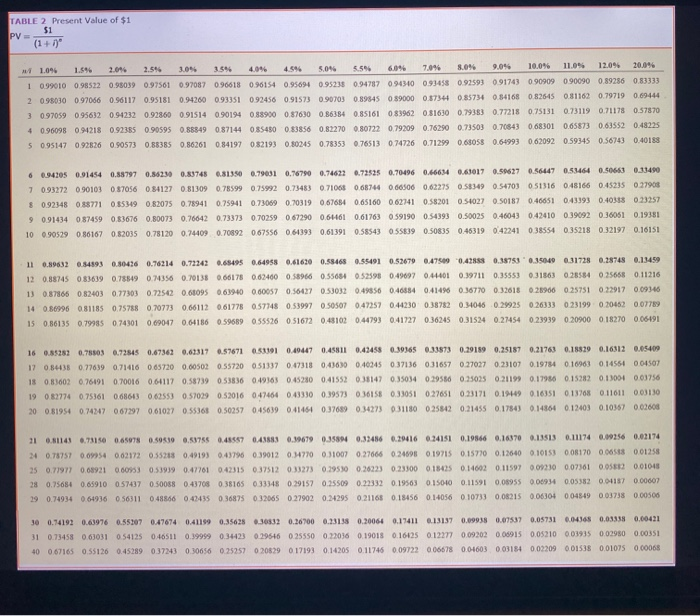

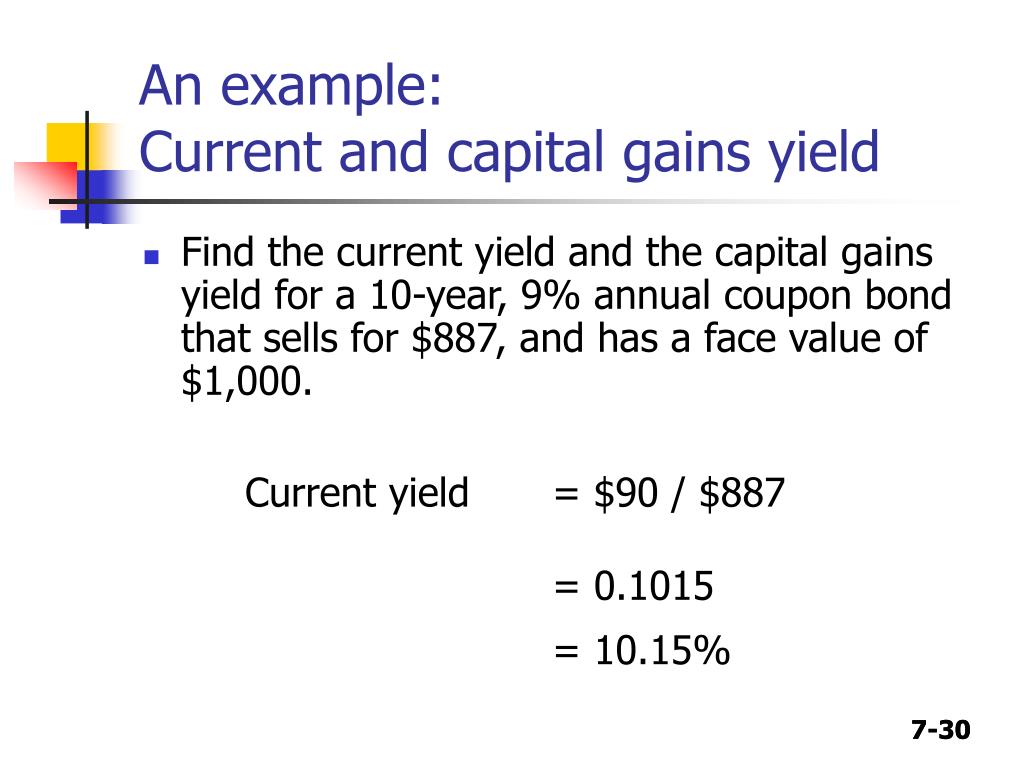

How to Calculate the Price of Coupon Bond? - WallStreetMojo Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 years. The effective yield to maturity is 7%. Determine the price of each C bond issued by ABC Ltd. Below is given data for the calculation of the coupon bond of ABC Ltd. A 10-year bond with a 9% annual coupon has a yield to maturity… A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is NOT … read more Neo 14,498 satisfied customers The Carter Companys bonds mature in 10 years have a par value

Question 12 a 10 year bond with a 9 annual coupon has Question 12 A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? Selected Answer: If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price.

A 10 year bond with a 9 annual coupon

a-10-year-bond-with-a-9-percent-annual-coupon-has-a-yield A 10-year bond with a 9 percent annual couponhas a yield to maturity of 8 percent. Which of the following statements is most correct? a. The bond is selling at a discount. b. The bond's current yield is greater than 9 percent. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d. Solved A 10-year bond with a 9% annual coupon has a yield to | Chegg.com A 10-year bond with a 9% annual coupon has a yield to maturity of 8% which statement about this bond is correct? O a. The bond is selling at a premium to its par value. O b. The bond is selling at a discount to its par value. O c. The bond is selling below its par value O d. The bond is price to sell at its par value. Save & Continue Answered: 7) Consider a 10-year 10% annual coupon… | bartleby A: Given, The price of bond is $1065.95 Life of bond is 9 years Yield to maturity is 7%. question_answer Q: Which of the following statements are true about unsecured bonds?

A 10 year bond with a 9 annual coupon. A 10 year bond with a 9 annual coupon has a yield to - Course Hero A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * 1/1 a. If the yield to maturity remains constant, the bond's price one year from now will be higher than its current price. b. The bond is selling below its par value. c. The bond is selling at a discount. d. Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. If the yield to maturity remains constant, the bond's price one year from now will be higher than its A 10-year corporate bond has an annual coupon of 9%. The bond is ... A 10-year corporate bond has an annual coupon of 9%. The bond is currently selling at par ($1,000). Which of the following statements is CORRECT? Group of answer choices The bond's yield to maturity is above 9%. The bond's current yield is less than its expected capital gains yield. If the bond's yield to maturity declines, the bond will sell ... Coupon Bond - Investopedia Coupon Bond: A coupon bond, also referred to as a bearer bond, is a debt obligation with coupons attached that represent semi-annual interest payments. With coupon bonds, there are no records of ...

A 10-year bond with a 9% annual coupon has a yield to maturity… I have a question: A 20-year, $1,000 par value bond has a 9% annual coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from … read more Chapter 7 Homework Finance Flashcards | Quizlet You hold two bonds, a 10-year, zero coupon, issue and a 10-year bond that pays a 6% annual coupon. The same market rate, 6%, applies to both bonds. If the market rate rises from its current level, the zero coupon bond will experience the larger percentage decline. b. The time to maturity does not affect the change in the value of a bond in ... Finance Chapter 8 Flashcards | Quizlet If John buys a 5-year bond with a 9% coupon rate paid semiannually and $1000 par value for $925, his yield to maturity would be closest to: Round to two decimal places. ... places. 10.99%. Briar Corp is issuing a 10-year bond with a coupon rate of 7 percent. The interest rate for similar bonds is currently 9 percent. Assuming annual payments ... A 5 year bond with a 12 percent annual coupon Question 9 1 1 point ... A 5-year bond with a 12 percent annual coupon. Question 9 1 / 1 point Which of the following is not considered a capital component for the purpose of calculating the weighted average cost of capital as it applies to capital budgeting? Question options: a) Long-term debt. b) Common stock. c) Short-term debt. d) Preferred stock. e) All of the above are considered capital components for WACC and ...

FINN 3226 CH. 4 Flashcards | Quizlet A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. b. Answered: A 10-year bond with a 9% annual coupon… | bartleby Transcribed Image Text: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? * If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. The bond is selling below its par value. The bond's current yield is greater than 9%. Answered: 1. A 12-year bond has a 9 percent… | bartleby A 12-year bond has a 9 percent annual coupon, a yield to maturity of 8 percent, and a face value of P1,000. a. What is the current yield of the bond? b. What is the price of the bond? 2. An annual coupon bond with a P1,000 face value matures in 10 years. The bond currently sells for P903.7351 and has a 9 percent yield to maturity. [Solved] A 10-year bond with a 9% annual coupon has a yield to maturity ... A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. The bond is selling below its par value. b. The bond is selling at a discount. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d.

Answered: Suppose a 10-year, $1,000 bond with an… | bartleby Q: What is the yield to maturity on a 10-year, 9% annual coupon, $1,000 par value bond that sells for… A: In the given above question we need to compute the yield to maturity on a bond. We can solve this…

Answered: 13. A 10-year corporate bond has an… | bartleby b. The bond's current yield is 9 percent. c. If the bond's yield to maturity remains constant, the bond's price will remain at par. d. Statements a and c are correct. e. All of the statements above are correct. 13. A 10-year corporate bond has an annual coupon payment of 9 percent. The bond is currently selling at par ($1,000).

A 10-year $1,000 par value bond has a 9% semiannual - SolutionInn A 10-year $1,000 par value bond has a 9% semiannual coupon and a nominal yield to maturity of 8.8%. What is the price of the bond? Coupon A coupon or coupon payment is the annual interest rate paid on a bond, expressed as a percentage of the face value and paid from issue date until maturity.

Solved A 10-year bond with a 9% annual coupon has a yield to - Chegg Question: A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value b. the bond is selling at a discount c. the bond will earn a rate of return greater than 8% d. the bond is selling at a premium to par value This problem has been solved!

Bond Price Calculator Let's assume that someone holds for a period of 10 years a bond with a face value of $100,000, with a coupon rate of 7% compounded semi-annually, while similar bonds on the market offer a rate of return of 6.5%. Let's figure out its correct price in case the holder would like to sell it: Bond price = $103,634.84

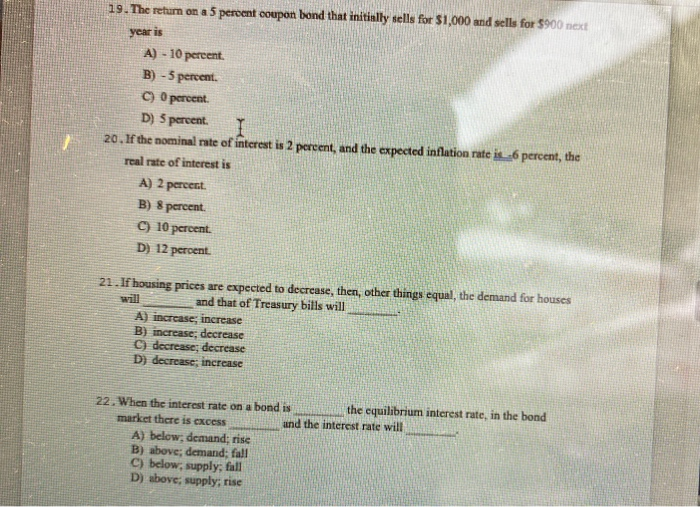

Consider a 7 year bond with a 9 coupon and a present 10. A bond pays a semi-annual coupon and the last coupon was paid 74 days ago. If the annual coupon payment is $65, what is the accrued interest? A) $13.21 B) $14.12C) $15.44 D) $16.32 11.A bond has a 5% coupon rate. The coupon is paid semi-annually and the last couponwas paid 35 days ago.

A 10-year bond with a 9% annual coupon has a yield to...ask 5 - Quesba A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following... A 10-year bond with a 9% annual coupon has a yield to maturity of 8%. Which of the following statements is CORRECT? a. the bond is selling below its par value b. the bond is selling at a discount c. the bond will earn a rate of return greater than 8%

Buying a $1,000 Bond With a Coupon of 10% - Investopedia Owning a 10% ten-year bond with a face value of $1,000 would yield an additional $1,000 in total interest through to maturity. If interest rates change, the price of the bond will fluctuate above...

Answered: 7) Consider a 10-year 10% annual coupon… | bartleby A: Given, The price of bond is $1065.95 Life of bond is 9 years Yield to maturity is 7%. question_answer Q: Which of the following statements are true about unsecured bonds?

Solved A 10-year bond with a 9% annual coupon has a yield to | Chegg.com A 10-year bond with a 9% annual coupon has a yield to maturity of 8% which statement about this bond is correct? O a. The bond is selling at a premium to its par value. O b. The bond is selling at a discount to its par value. O c. The bond is selling below its par value O d. The bond is price to sell at its par value. Save & Continue

a-10-year-bond-with-a-9-percent-annual-coupon-has-a-yield A 10-year bond with a 9 percent annual couponhas a yield to maturity of 8 percent. Which of the following statements is most correct? a. The bond is selling at a discount. b. The bond's current yield is greater than 9 percent. c. If the yield to maturity remains constant, the bond's price one year from now will be lower than its current price. d.

Post a Comment for "40 a 10 year bond with a 9 annual coupon"