39 is yield to maturity the same as coupon rate

Why do we use yield to maturity instead of coupon rate for cost ... - Quora Answer (1 of 4): Because the yield to maturity more consistently represents the cost of the debt. If a coupon bond is sold at par, and the coupons are paid, and then the bond is redeemed — both would be (almost) the same. Imagine (for example) a company issuing a bond that has a zero coupon, and... Coupon vs Yield | Top 8 Useful Differences (with Infographics) The coupon rate of a bond is the amount of interest that is actually paid on the principal amount of the bond (at par). While yield to maturity defines that it's an investment that is held till the maturity date and the rate of return it will generate at the maturity date.

Why is the yield to maturity of a bond equal to the coupon rate ... - Quora Answer (1 of 3): If we're talking about straight bonds that are issued at $1000, the coupon, the current yield and YTM are identical in the instant they are issued, and probably never again. That's because current yield and YTM are a function of time and market price, which will constantly chang...

Is yield to maturity the same as coupon rate

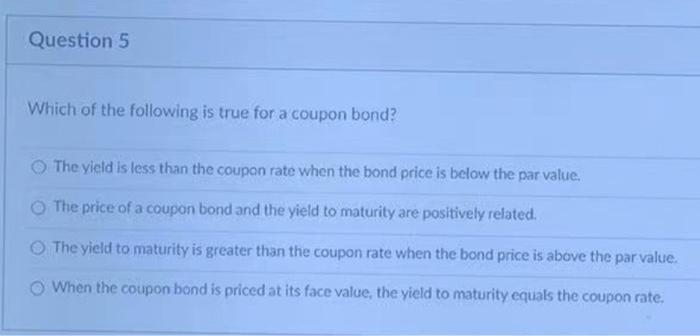

Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value(the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Solved If the yield to maturity and the coupon rate are the - Chegg Finance questions and answers. If the yield to maturity and the coupon rate are the same, then the bond should sell for ______.a. a premium b. a discount c. par valueTo answer enter a, b, or c. SubmitAnswer format: Text. Understanding Coupon Rate and Yield to Maturity of Bonds The resulting YTM will differ from the coupon rate. This is simply because interest rates change daily. To prove this point, say a month later you decide to purchase the same RTB 03-11 in the secondary market. However, Interest rates increased. From 2.375%, quoted yield increased to 2.700%.

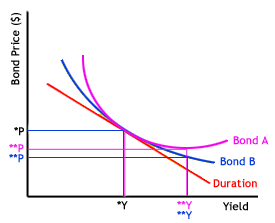

Is yield to maturity the same as coupon rate. When is a bond's coupon rate and yield to maturity the same? A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, or the stated value of the bond at the time of... Difference Between Yield to Maturity and Coupon Rate The key difference between yield to maturity and coupon rate is that yield to maturity is the rate of return estimated on a bond if it is held until the maturity date, whereas coupon rate is the amount of annual interest earned by the bondholder, which is expressed as a percentage of the nominal value of the bond. CONTENTS 1. Yield To Maturity Vs. Coupon Rate: What's The Difference? If an investor purchases a bond at par or face worth, the yield to maturity is the same as its coupon charge. If the investor purchases the bond at a reduction, its yield to maturity shall be increased than its coupon charge. A bond bought at a premium may have a yield to maturity that's decrease than its coupon charge. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions.

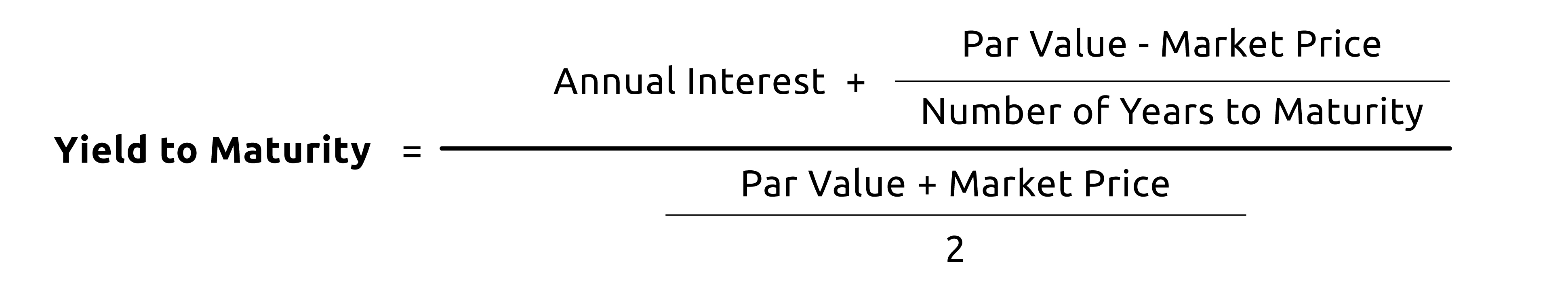

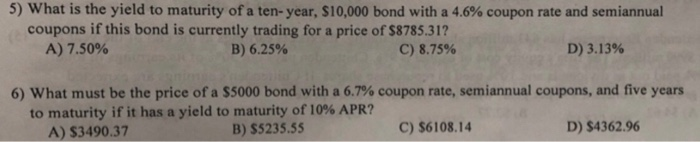

Yield to Maturity vs. Coupon Rate: What's the Difference? If an investor purchases a bond at par or face value, the yield to maturity is equal to its coupon rate. If the investor purchases the bond at a discount, its yield to maturity will be higher than... Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Coupon rate is a fixed value in relation to the face value of a bond. If yield to maturity is greater than the coupon rate, the bond is trading at a discount to its par value. Difference Between Coupon Rate and Yield to Maturity The main difference between Coupon Rate and Yield to Maturity (YTM) is that Coupon Rate is the fixed sum of money that a person has to pay at face value. In contrast, Yield to Maturity (YTM) is the amount a person will retrieve after the maturation of their bonds. The Coupon Rate is said to be the same throughout the bond tenure year. Yield to Maturity (YTM) - Overview, Formula, and Importance On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: The approximated YTM on the bond is 18.53%. Importance of Yield to Maturity

Difference Between Coupon Rate and Yield of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Yield to Maturity (YTM) Definition & Example - InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Coupon Rate - Meaning, Example, Types | Yield to Maturity Comparision Therefore, if the 5-Year Treasury Yield becomes 4%, still the coupon rate will remain 5%, and if the 5-Year Treasury Yield increases to 12% yet, the coupon rate will remain 10%. Coupon Rate Vs. Yield to Maturity. Many people get confused between coupon rate and yield to maturity. In reality, both are very different measures of returns. As ... Yield to Maturity vs Coupon Rate: What's the Difference While the coupon rate determines annual interest earnings, the yield to maturity determines how much you'll make back in interest throughout the bond's lifespan. The YTM considers market changes because, even though your bond's interest rate will not change, its value will fluctuate depending on the market's rates.

Solved Is the yield to maturity on a bond the same thing as - Chegg This problem has been solved! Is the yield to maturity on a bond the same thing as the required return? Is YTM the same thing as the coupon rate? Suppose today a 10 percent coupon bond sells at par. Two years from now, the required return on the same bond is 8 percent. What is the coupon rate on the bond then?

Chapter 10 Flashcards | Quizlet Coupon rate, current yield, and yield to maturity are all the same. ... c. Coupon rate > Yield to maturity > Current yield d. Yield to maturity > Coupon rate > Current yield. a. Consider a five-year bond with a 10 percent coupon that is presently trading at a yield to maturity of 8 percent. If market interest rates do not change, one year from ...

FIN 221 Exam 1 Flashcards | Quizlet If a bond's yield to maturity exceeds its coupon rate, the bond's price must be less than its maturity value. c. If two bonds have the same maturity, the same yield to maturity, and the same level of risk, the bonds should sell for the same price regardless of the bond's coupon rate. d. Answers b and c are both correct. e.

Understanding Coupon Rate and Yield to Maturity of Bonds The resulting YTM will differ from the coupon rate. This is simply because interest rates change daily. To prove this point, say a month later you decide to purchase the same RTB 03-11 in the secondary market. However, Interest rates increased. From 2.375%, quoted yield increased to 2.700%.

Solved If the yield to maturity and the coupon rate are the - Chegg Finance questions and answers. If the yield to maturity and the coupon rate are the same, then the bond should sell for ______.a. a premium b. a discount c. par valueTo answer enter a, b, or c. SubmitAnswer format: Text.

Important Differences Between Coupon and Yield to Maturity Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value(the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate.

Post a Comment for "39 is yield to maturity the same as coupon rate"